One of the biggest challenges retailers face is the cost of handling cash. Between counting cash repeatedly, reconciling cash drawer amounts, and transporting bills and coins to the bank, a lot of time and money is spent on managing the process. In a recent conversation with a Tier 1 retailer, we learn they count/handle cash up to 22 times from the time of receipt to the time of deposit.

Trusted advisors solve problems, but don’t necessarily sell products. POS VARs who help their customers alleviate these cash management challenges can also help themselves in the long term by becoming a trusted advisor. VARS who can build, integrate and install cash management solutions for their customers will be rewarded for helping them solve a serious problem.

Retailers typically view this inefficiency as a cost of doing business, but it doesn’t have to be this way. POS resellers and integrators can guide retailers to the light by showing them how to reduce cash handling costs with automated cash management solutions.

If all you do is focus on selling hardware, you limit your revenue-generating capacity and risk pushing customers into the arms of a competitor that knows how to install cash management solutions and integrate them with POS systems.

Talk to Customers

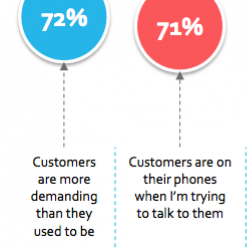

Talk to your clients about their payment challenges. Cash as a form of tender still represents 30% of a retailer’s transactions and as such should be discussed in this conversation, specifically their cash-handling challenges. Most likely, they are grappling with pressures and requirements brought on by things like the EMV liability shift and the stunning number of mobile wallets now available. A current estimate puts the number of mobile wallet payment types at 168! How can retailers manage that many? It’s hard enough to pivot between cash, credit and debit from one customer to the next.

The first thing is to tell your customers is that cash isn’t going away. With over 1.4 trillion dollars of currency in circulation, the Federal Reserve estimates that cash accounts for 40% of all transactions, far higher than the next payment method – debit – which makes up 25% of transactions. Credit, meanwhile, accounts for 18%.

Explain the Costs of Counting Cash

Next, help customers understand how much they spend on physical cash handling and explain the benefits of an automated process. From the retailer example above, who was counting cash up to 22 times (including checkout reconciliations and multiple backroom counts) – that’s a lot of staff time spent on something a machine can do faster and more accurately. Year over year, businesses pay a substantial amount for manual counting discrepancies. Instead of manual cash counts, automation provides reliable, accurate data on cash sums contained in the tills at all times.

A 2011 study broke down cash-handling costs thus:

- 45% employee handling time

- 23% transportation and banking

- 16% interest cost on store funds

- 9% reconciliation time

- 7% internal theft

Besides cutting costs, cash management automation improves the customer experience at the checkout. Consider how stores typically go about cash reconciliation and till top-offs: A manager comes around with a sheet of paper, interrupting cashiers one by one to get a count of bills and coins, forcing customers to wait through the process.

The manager then goes in the back, picks up bundles of cash denominations, and returns to the checkouts to top off the drawers. Again, patrons have to stand and wait. In some cases, customers see long checkout lines and leave. They may or may not return later.

Sell the ROI of Cash Management Solutions

The last point to emphasize to retailers about cash management solutions is quick ROI. We’ve seen large grocery retailers attain returns in as little as nine months, though typically it’s 11 to 14 months. APG’s SMARTtill Cash Management Solution can reduce cash losses by up to 90%. Once your customers understand all the benefits of automated cash management, they’ll want to make the investment, but they can’t do that if you don’t introduce cash management solutions to them.

For more on cash management solutions, see our SMARTtill Intelligent Cash Drawer or the Cashlogy Cash Recycler.