Retailers are constantly looking for solutions that make payments easier and more automated. After all, an easy payment process also makes it easier to spend money, at least when it comes to small amounts and quantities. According to a study by Juniper Research, that’s also why technologies like zero-click payment – also called “invisible payment“ – are capable of making a lasting impact on the retail industry in the coming years.

In the case of so-called zero-click payments, the payment process is automatically triggered and happens in the background without disrupting the user. As a part of omnichannel strategies, this time-saving payment option we know from subscriptions is designed to make shopping more attractive.

“Invisible or zero-click payments are definitely on the rise. Customers enjoy shopping – but not the payment process,“ explains Ralf Ohlhausen, Business Development Director at PPRO, a Fintech service company. “I personally think the potential is huge. Wherever it is technically feasible – and this trend will advance rapidly – retailers will eliminate the cumbersome payment process.“ According to Juniper, transactions in excess of 78 billion dollars are expected to be processed using “invisible” payment technologies by 2022. This estimate is based on the expected 9.8 billion U.S. dollars in retail revenues in 2017.

Online retailers and their web stores have shown how convenient payments can work. Thanks to stored account data and settings, the payment process can be completed with just one click. Brick-and-mortar stores use cameras, sensors, and artificial intelligence to facilitate automatic payments.

“Needless to say, this endeavor must not come at the expense of security, that is to say, both the customer and the retailer must have the assurance that the store doesn’t overcharge or undercharge.“ (Ralf Ohlhausen)

Do mobile devices make cash registers obsolete?

Oftentimes, customers already carry the technology for cashless payment processes in their pockets by way of mobile devices such as smartphones, tablets or smartwatches. According to Juniper Research, over the next five years, these payment solutions will cover more than 5,000 retail outlets. Over the same period, the number of consumers who scan their own purchases via checkout apps will increase from just shy of 4 million to more than 30 million transactions.

Amazon and its pilot project Amazon Go, a supermarket that has no checkout stations, also intends to replace the physical checkout method in retail. The customer checks into the store with his/her smart device, takes the desired items from the shelf and leaves the store without having to pass through a checkout system. Cameras and sensors identify the products the consumer is purchasing. When customers leave the store, payment is made via the Amazon account.

Having said that, the opening of the first Amazon Go store in Seattle has been delayed since its originally scheduled launch date in March 2017. The technology still encounters some issues once the number of customers in the store exceeds a certain number.

Automatic payment in online retail

The zero-click payment solution is not just interesting for brick-and-mortar retail. The e-commerce sector is also striving to make the payment process as automated and simple as possible. One example of this is the Amazon Dash Button, which lets consumer order everyday items such as detergents or trash bags at the push of a button. Once the customer presses the plastic button, the preprogrammed item is reordered and paid for via the registered Amazon account.

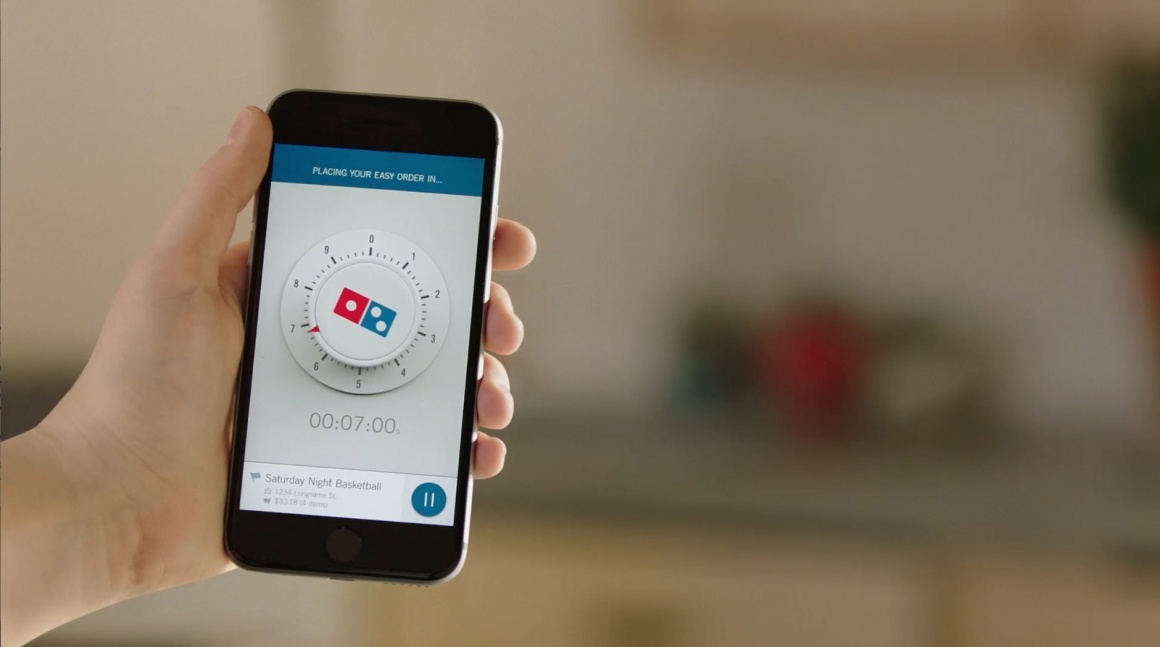

Domino’s Pizza also offers an invisible payment option with its zero-click ordering app. Once you open the app, your favorite selection is automatically ordered unless you cancel the process within ten seconds.

Having said that, so far, these solutions only facilitate purchases of only one preselected product. Shopping carts containing more than one item or product changes cannot be processed using an invisible payment option. That’s also why invisible payment processes are still a niche in online retail.

Meanwhile, the zero-click payment method is successfully used for services. For example, in the case of the online ride service provider Uber in the U.S., owed fares for rides are automatically paid via PayPal using the smartphone app.

Retail revolution or cautious trend?

In its report titled “Future In-store Retail Technologies: Adoption, Implementation & Strategy 2017-2022“, Juniper Research concluded that the cost and complexity of infrastructure integration will constrain deployments of invisible payments systems in the short term. It argues that initially, two other retail technologies would take root in brick-and-mortar retail: checkout apps and automatic scanning.

“All told, it can be expected that Germany will likely continue to play catch-up with the adoption of new end-user technology.“ (Ralf Ohlhausen)

These two solutions have lower upfront costs and can be used as information and promotion platforms. Juniper Research estimates that these technologies will drive an average increase in revenue of over 300 U.S. dollars per shopper annually by 2022.

These precursors, where customers scan their own purchases and pay via an app on their smartphone, could pave the way for invisible payment processes. However, they could also bring technical issues or data protection concerns to light. For example, the Amazon Go store has many critics who caution against unrestricted in-store customer monitoring. Especially in Germany, consumers still prefer methods of payment where security takes priority over convenience.

Ralf Ohlhausen believes that zero-click payment solutions are likely to first be adopted in China’s or the U.S. retail sector where there is less concern about new (payment) technologies and the sharing of sensitive information. “Especially as part of the ’Internet of Things‘, this will definitely have to be the case. After all, if cars are able to buy gas and refrigerators purchase milk, they should also be able to pay for these items on their own.“