The Retail Feedback Group (RFG), a leader in providing actionable stakeholder feedback, today released the 2016 U.S. Supermarket Experience Study. The research, now in its ninth year, found that supermarkets, on a five-point scale where five is highest, continue to generate high satisfaction among their shoppers, scoring an average of 4.39, as well as foster a strong referral rate with an average likelihood to recommend score of 4.48. Despite these high satisfaction and referral scores, an opportunity still exists to address lower scoring areas to grow loyalty and sales, which is especially important in today's highly competitive environment.

Core experience factors provide key barometers of supermarket channel performance

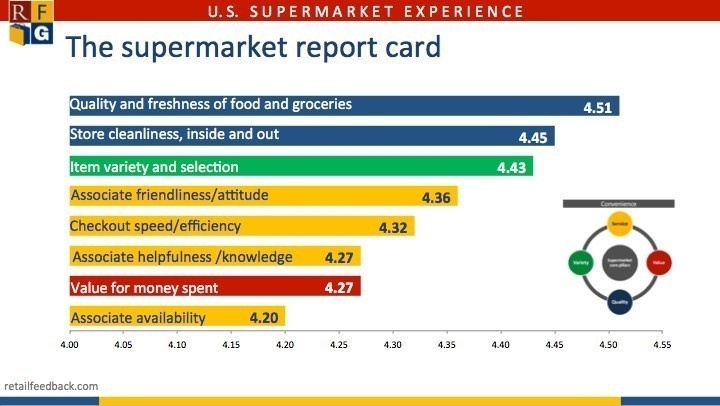

Examining key supermarket retailing fundamentals illustrates that supermarkets performed well in some of these critical areas yet show room for improvement in others.

- Quality/Cleanliness: Supermarket shoppers rated quality/freshness of the food and groceries (4.51) followed by cleanliness of the store (4.45) as the two highest-rated core experience factors.

- Variety: Also a higher-scoring factor, item variety and selection registered at 4.43.

- Service: Associate availability scored lowest among all the core experience factors (4.20). The other service factors – associate friendliness/attitude (4.36), associate helpfulness/knowledge (4.27), and checkout speed/efficiency (4.32) – only showed moderate ratings.

- Value: Value for the money spent on this visit received the second lowest rating at 4.27. Drilling down deeper into prices, the results show meat (4.01), produce (4.06) and everyday prices (4.07) all generated low scores in the supermarket channel, while advertised sales items scored much higher (4.41).

Doug Madenberg, RFG Principal noted, "Not one of the service attributes scored at the top of the core experience factors, yet it is imperative to find ways to strengthen customer service. Our research shows that when service receives high scores, the average trip satisfaction is significantly higher along with spending in the short-term and loyalty in the long-term. As a result, we can't stress strongly enough the impact that store employees have on the shopping experience, whether it is fostering a pleasant interaction, providing service above and beyond expectations, or simply being available to help."

Satisfaction declines among shoppers throughout the day

Considering overall satisfaction with the trip, as well as on all of the core experience factors, the research found that satisfaction declines as the day progresses. Highest scores registered before 11 a.m. with lowest scores found after 7 p.m. This finding illustrates an opportunity to evaluate channel readiness during peak evening shopping hours.

Advertising vehicles straddle traditional, social, mobile and digital media

Supermarket shoppers continue to use money-saving measures but the mix of these measures is evolving. Overall, 77 percent of shoppers referred to one or more advertising or sales vehicles before or during the store visit. The top money-saving measure, used by 56 percent of shoppers, was reviewing the traditional paper circular at home. An additional 31 percent reviewed the circular in the store and 26 percent examined the circular digitally. Clipping paper coupons (obtained from newspapers or other printed sources) registered at 38 percent, while downloading digital coupons was at 27 percent and in-store promotions at 22 percent. Money-saving measures used less frequently were loyalty card offers (19 percent), smartphone research (12 percent) and social media specials (7 percent).

Millennials migrating to digital faster

Examining the use of money-saving measures by generation, the research shows that Boomers reviewed the circular at home (64 percent) and clipped paper coupons (45 percent) at much higher rates than Millennials (46 percent and 31 percent, respectively). Millennials, on the other hand, utilized smartphone research (22 percent) and social media specials (13 percent) at higher percentages than Boomers (6 percent and 4 percent, respectively).

Brian Numainville, RFG Principal, observed, "As younger generations, specifically Millennials and Generation Z, continue to grow in their spending influence over the coming years, supermarket advertising will need to increasingly blend traditional vehicles with social, mobile and digital. Retailers should carefully evaluate their markets and shopper base on an ongoing basis to ensure the right mix."