Digitization is advancing rapidly in the area of checkout solutions, cash registers and payments. The "Interessengemeinschaft Zukunftsweisende Technologiehersteller für Kassensysteme" or IGZTK (Association of Future-Oriented Technology Manufacturers for POS Systems) aims to facilitate access to and educate about innovative technologies such as the cloud.

Now the providers orderbird, ready2order, studiolution, tillhub, Anker, gastronovi and Lightspeed have spun off an independent association. We asked one of the board members – Frank Schlesinger, CTO of orderbird – about the IGZTK's goals.

Also, we were interested in: What are the advantages of cloud-based checkout systems? And what technological innovations are still to come for users of checkout systems?

How did the foundation of the association come about?

Frank Schlesinger: The reason for our founding of the association was the changes in the Fiscalization Act in Germany. The law to protect against manipulation of basic digital records was passed by the Bundestag in 2016. By January 01, 2020, every cash register had to be equipped with a technical security device (TSE or Technische Sicherheitseinrichtung).

In principle, anything that prevents tax fraud and sets quality standards is a good thing. Nevertheless, we as POS system manufacturers felt very much left alone with this requirement.

With us as cloud-based POS system manufacturers, our customers' data is no longer in the retail store, in the restaurant, in the hair salon. Instead, it is transferred to the data center the moment it is entered and is therefore tamper-proof.

At the time, however, the Federal Ministry of Finance and the Federal Office for Information Security had a completely different idea of what a POS system looked like: They were thinking of a box on a counter. Manufacturers of TSEs developed their solutions accordingly: very hardware-centric.

But the reality was different: For the large proportion of POS systems in Germany that are either web browser-based or use tablets as input devices, whose entire POS logic is located in a backend in the cloud, these TSE solutions do not work.

In this situation, I approached our competitors, because we all had the same problem. This resulted in association work, we established contacts with organizations and authorities and explained the problem.

What have you achieved politically since then?

In the meantime, we have been able to influence the certification of cloud-based TSEs. However, this was only achieved after the legal deadlines had already expired. We worked to prevent damage to our customers, who had been using systems that had not yet been certified for a certain period of time.

In practice, there are still a lot of unanswered questions, for example regarding the inspection of checkout systems and the work of the tax auditors. I therefore assume that a great deal will still be learned in the coming months.

How far have companies progressed with the technical implementation of the Cash Register Security Ordinance?

Exact figures are difficult to determine.

We at orderbird have a TSE rollout rate of around 90 percent among our customers. Among the remaining ten percent, there will be some restaurateurs who have not yet reopened, but there are certainly also businesses that have not yet recognized the urgency.

But what I see when I walk down the street in Berlin: The big chains, the professionals, they're all fiscalized. You can see that on the receipt from the encrypted checksum. But often I don't get any receipt at all, many times I see old yellowed cash registers that can't have any TSE at all. From this subjective observation, I estimate more like a 50 percent rate.

So what does a cloud-based POS system mean for the daily work of a retailer?

Well, the simplest answer is: not much at all. A decent POS system means having the tools you need. If I can integrate functions such as inventory management, operate the software easily and pay for it all, then I don't really care about the system behind it.

Nevertheless, I find that a cloud system has many advantages. Some of them are also related to the "software as a service" (SaaS) business model.

With a cloud system, I as a customer participate in the technical development, I receive security and software updates, and I have a service partner who is available around the clock, plus I benefit from new solutions and interfaces. And our POS systems generally offer a better user experience as well.

Digital business models just happen to be successful, think of streaming offers for music or series. People want the best and largest possible portfolio without having piles of stuff sitting around, and they want it easily on any mobile device. If you run a store, you want to focus on the business and selling. A retailer has many needs in terms of security, payment methods, software development, data sharing and usage. But he doesn't want to have to deal with the complexity of it all.

Besides the cloud, what other technologies and innovations will retailers and users of checkout systems be facing in the next few years?

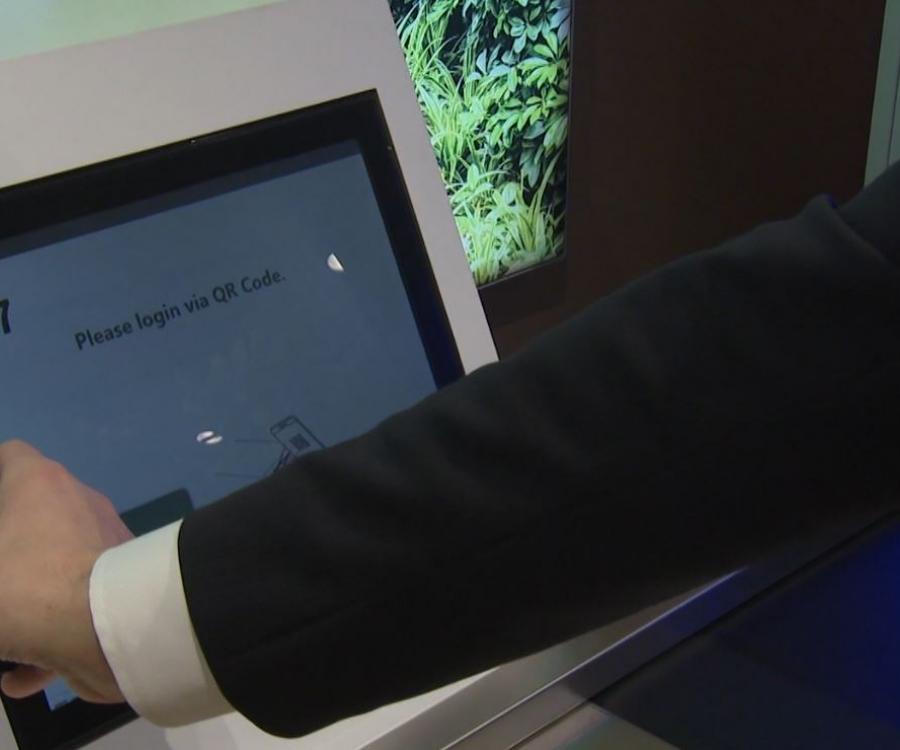

In Germany, the first checkout systems that are all-in-one devices are now on the market. This means that a sales employee has a smartphone with an integrated card reader terminal and receipt printer and can accept electronic payments and create tax-compliant invoices and receipts anywhere.

A second important topic is big data. Manufacturers of cloud-based POS systems are actually increasing the competition: orderbird, for example, has traffic data from 14,000 customers from several countries. From this, we can tell when a product is offered too cheaply or too expensively, for instance. We can use this data to develop products that give entrepreneurs guidance for business decisions. And this knowledge is then no longer just available to the large chains, but also to small, independent entrepreneurs.

How do Germany and Europe actually compare internationally when it comes to the market for checkout system providers?

In Europe and also in Germany, the POS market is highly fragmented, also in terms of the technological bandwidth; there are both long-established and very young companies on the market. One thing we have observed in the USA: The topic of payment has driven the development of checkout systems there. Providers such as Square or Toast have offered payment solutions to merchants as SaaS, and the checkout was virtually included.

Historically, in Germany there is less acceptance for new things, for clouds, e-payment, contactless payment, and so on. On top of that, we have a bureaucracy that makes innovative developments difficult. When I'm on the road in associations and committees, I always hear a lot about Europe's digital sovereignty. But we are dependent on the platforms of the Americans, and soon perhaps even on those of the Chinese. This is also what we as IGZTK are trying to do when it comes to POS solutions: To not only observe the great developments of others, but to tackle them ourselves.