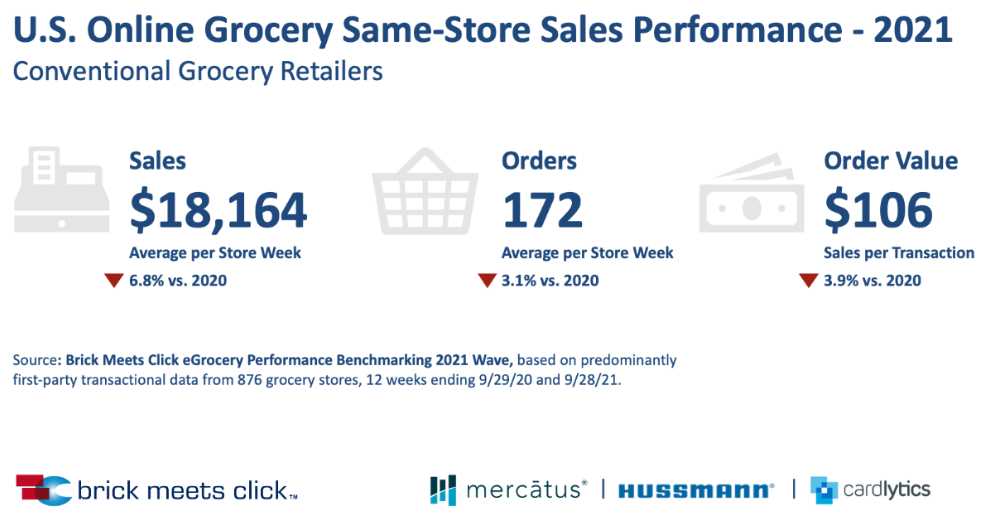

Conventional grocers reported a 6.8% drop in online grocery sales on a same-store basis during the 12 weeks ending September 28, 2021, versus the prior year, according to the Brick Meets Click eGrocery Performance Benchmarking 2021 Wave. A 3.1% decrease in orders combined with a 3.9% decline in the average order value contributed to the drop in sales on a year-over-year basis.

The recently completed research, sponsored by Mercatus, Hussmann Corporation, and Cardlytics, resumed the benchmarking initiative that Brick Meets Click started in 2016 but paused in 2020 due to the pandemic. Based on online transactional data linked to non-personal identified households across nearly 950 stores from 45 U.S. banners, the study is the largest independently conducted online grocery benchmarking initiative completed to date.

“We know from our monthly eGrocery shopping survey that Mass is driving the online grocery sales gains in the broader U.S. market,” said David Bishop, partner at Brick Meets Click, “so benchmarking is incredibly valuable because it enables Grocery retailers to compare their performance versus their peers to identify improvement opportunities.”

The first of the initiative’s three reports releases this week and focuses on Topline Performance Findings, including key causal factors that can impact performance, such as how long a service has operated, what services are offered by each store, and where the store operates. Among the findings:

- Age of online operations did not significantly impact overall performance. The 7% of locations that had operated their online grocery services for less than a year did not report significantly lower sales compared to stores with longer running operations, likely due to COVID-related circumstances. Before COVID, Brick Meets Click documented a strong and positive correlation between sales and the age of the service.

- Offering customers multiple ways to receive orders did impact performance results. Weekly online grocery sales for stores that offered both pickup and delivery were 44% higher than stores offering only delivery and 55% higher than stores offering only pickup. In aggregate, delivery accounted for over 60% of all online orders, but when stores allowed customers to receive orders via either delivery or pickup, delivery’s share dropped to just over 50%. Only 49% of stores in the sample offered customers the choice between the two methods.

- Stores in medium-sized markets generated higher weekly sales than stores in more-populated trade areas. This is a significant flip compared to the 2019 benchmarks, and most likely due to the growth in the availability of competing online services in the larger markets.