There are many payment apps, but most only accept debit or credit cards. The problem for Germans: they prefer the Girocard.

VR Payment GmbH has the solution with its VR-pay:Me app, taking into account the habits of German customers. An interview with CEO Carlos Gómez-Sáez.

Mr. Gómez-Sáez, why did VR Payment decide to create their own app?

It's simple: there was no payment app for businesses that meets the specific needs of the German market. In Germany, consumers prefer the Girocard for cashless payments – almost every German has one. VR-pay:Me now lets businesses accept smartphone payments via the secure, domestic Girocard system – quickly, conveniently and at attractive prices.

What does the app offer?

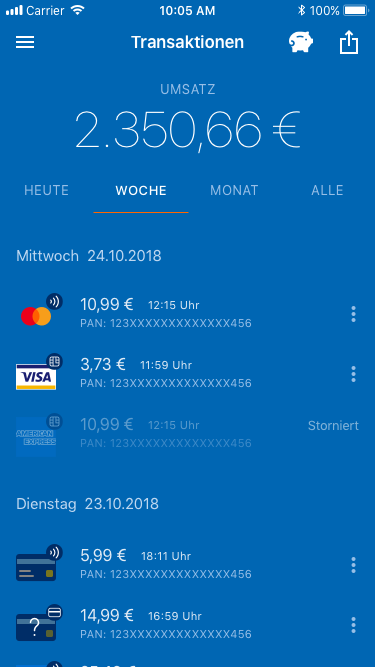

In addition to Girocard, the app accepts all major debit and credit cards, as well as Apple Pay and Google Pay. It provides fully digital receipt management and a comprehensive backend that allows merchants to view their transactions in real time. The integrated information system also provides you with important changes and notes on cashless payment transactions. There are also special features such as a shortcut key for fixed amounts or the integrated calculator.

What technology does a business need to offer VR-pay:Me and what does that mean for cashiers?

All a merchant needs to accept payments with VR-pay:Me is a smartphone and an acceptance contract. They can easily request and complete it at www.vr-pay.me. We then send them a small, mobile card reader. The merchant downloads the VR-pay:Me app via the Google Play Store or the Apple Store, connects his smartphone to the terminal – that's it.

The app is intuitive to use and does not require any prior knowledge. Cashiers type the amount of the bill into the app and follow the system instructions. Several cashiers can also accept payments via the app: sales can be assigned to individuals with VR-pay:Me – a helpful feature, especially when it comes to tips.

What separates this app from other solutions?

In addition to Girocard acceptance – SumUp and iZettle, for example, use the more expensive, international debit systems Maestro and V Pay – unlike the competition, we offer two different price models. This allows every business to optimize their costs as needed.

The flat-rate version VR pay compact includes everything for 15.90 euros a month for a sales volume of 1,500 euros. There are no additional costs for using the app or individual transactions. This is ideal for kiosk owners, market stalls or delivery and courier services, for example.

For companies that only have a handful of transactions per month or a high rate of individual sales, we recommend VR pay flex: costs are based only on actual sales through the app. No contract period, no basic charges. A transaction costs 20 cents plus an average of 0.185 percent for Girocard payments; for debit card payments it is 0.65 percent fees and credit cards 1.99 percent.

The app is designed primarily for the German market. Can international customers pay with it?

Of course. VR-pay:Me lets you accept Maestro and V Pay debit cards of international standard, as well as the credit cards Visa and MasterCard, JCB, Union Pay, Diners Club / Discover and, if the business desires, even American Express. Google Pay and Apple Pay can also be accepted through the app. This makes a business ideally equipped for international customers.

The official launch was 1 July 2019. How many businesses are using the app? What kind of feedback are you getting?

The demand is high, the initial feedback from users has been consistently positive. We also tested the app very extensively and adjusted and improved it prior to launch according to the feedback from our test businesses.

In your opinion, how will payments and cash registers change in the next few years?

The shopping behaviour of consumers is changing, and so is commerce and payment. Convenience is the focus: shopping is possible anytime, anywhere. It has to be fast and convenient, and the payment process almost invisible. No one likes to stand at a cash register.

Even if conventional POS systems are still valid today: more and more mobile solutions are in demand, particularly those that enable seamless payment across all channels. Digital marketplaces and ecosystems will become more important. Classic store concepts with traditional cash registers will have to reorient themselves over time. And I am convinced: we are only at the beginning of an exciting development.