A new report shows that out-of-stock rates for online purchases of consumer products in the U.S. are nearly twice as high as in-store availability. The report, issued by the Grocery Manufacturers Association (GMA), shows potential online sales losses as high as 17 billion dollars a year globally because products are not available when consumers want to buy them.

The report, “A Worldwide Study of Extent, Shopper Reactions, and Implications for Non-Food Online Retail Categories,” looks at online availability of baby care, fabric care, hair care, oral care, skin care, and shave care products at retailers in China, France, Germany, Japan, United Kingdom and the United States.

“This is one of the first studies on online availability after previous reports over the past decade studying on-shelf availability and its effects on consumer purchasing patterns,” said Keith Olscamp, a GMA director of industry affairs and collaboration. “The findings should encourage retailers and brands to collaborate and enhance online availability in the fast-growing area of online retail.”

The report highlights the significant sales revenue at stake for retailers and consumer goods manufacturers. To extrapolate to the industry level, the Global Top 100 publicly listed consumer goods manufacturers had sales of 1.7 trillion dollars (wholesale) in 2016. If 5 percent of sales is online and what is available online is 80 percent, then online sales are 85 billion dollars industry-wide, and the online lost sales opportunity is 17 billion dollars.

The report said that industry should improve its readiness significantly if it wants to compete in this growing segment of the business.

Key findings of the online availability report

The number of items that are available online (OLA) is 80 percent worldwide and 85 percent in the U.S. The 15 percent out-of-stock rate online in the U.S. is nearly double the out-of-stock rate of 8.3 percent for physical stores.

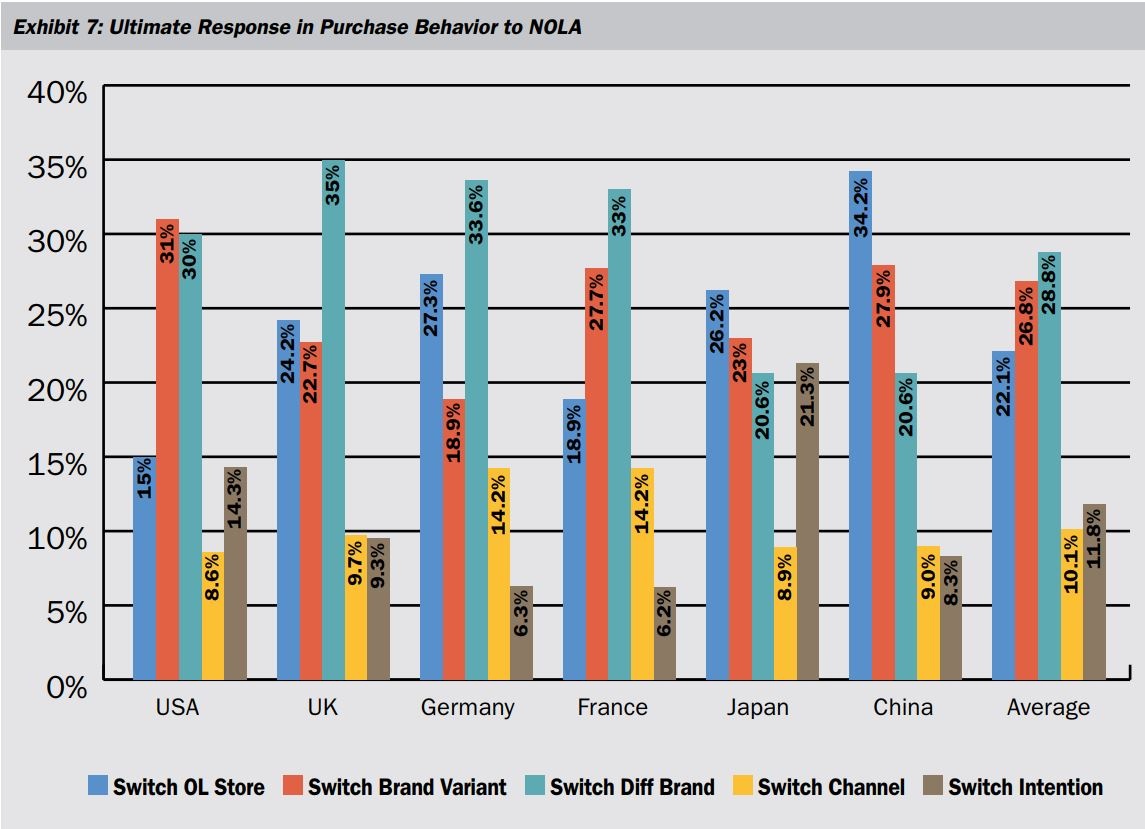

Consumer reaction to out-of-stocks are quite different in the online sales compared to stores. U.S. consumers are more likely to remain on the E-commerce site and switch a brand or substitute an item within the brand, which the researchers dubbed “the Amazon effect.”. However, if a physical store is out of a product, the consumers are more likely to switch to another store to find the product.

Worldwide, brands and retailers both suffer the adverse consequences equally when consumers do not find products available online. The report found that worldwide, 31 percent of the total loss is to retailers and 33 percent is to brands. In the U.S., retailers on average suffer 25 percent of the adverse consequences compared to 35 percent for brands when products are not available online.

The results of this first global study show that online availability (OLA) present substantial challenges to retailers and their suppliers of fast-moving consumer goods. The study finds what the authors say is a surprisingly large extent of products not available online as measured on online retail websites. In addition, the problem is exacerbated when retailers make a product digitally inaccessible by suppressing the online product page for technical or commercial reasons.

“Greater on-shelf availability of products is already a top priority for our industry, and this report shows the critical importance of reducing out-of-stocks for online sales as well,” Olscamp said. He added that GMA companies are working to cut out-of-stocks through the GMA Supply Chain Committee as well as a separate joint task force with retailers.