Research firm Martec International and RELEX, the first supply chain solution provider to offer retailers, wholesalers and manufacturers the power of in-memory computing, today announce the findings of their ‘State of the Retail Supply Chain 2016’ report, highlighting key priorities for supply chain managers globally.

The research asked retailers from the UK, North America, Germany and the Nordics, with annual sales exceeding €100 million ($110m), about the top issues affecting supply chain planning and execution; the challenges they face with forecasting, the visibility they have of their supply chain, whether they operate a single stock pool across all sales channels and how productive their staff are.

Based on interviews with 126 retailers, some of the key findings include:

- The top business issue cited by retailers globally is increasing availability without increasing stockholding (62%)

- The number one forecasting challenge globally is forecasting effectively across the supply chain (69%), followed by forecasting effectively for promotions and promotional lift (64%) and forecasting heavily seasonal items (60%)

- Analysis and reporting on the supply chain remains a key global challenge, with the production of reports, both standard and ad hoc, taking an average of 79 and 110 minutes respectively

Mikko Kärkkäinen, Group CEO, RELEX Solution comments: “For me, it is interesting to discover that whilst 64% of retailers globally highlighted forecasting for promotions as one of their main challenges, only 35% have a system in place that can build automatic demand forecast for promotions and only 22% have a system that can manage promotion stock run to clear fixtures for the next promotion.”

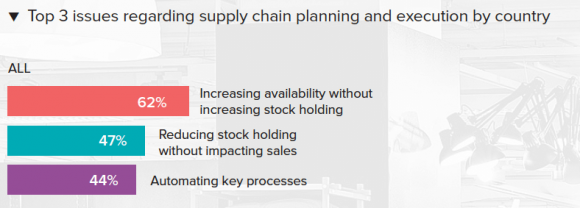

Issues regarding supply chain planning and execution

The top three business issues regarding supply chain planning and execution are increasing availability without increasing stockholding – highlighted by 62% of retailers, followed by reducing stockholding without impacting sales (47%) and in joint third automating key processes and better collaboration with suppliers (44% each).

However in the UK, retailers (52%) say that automating key processes is their top issue and this correlates with UK retailers stating that the joint top reason for replacing systems is because too much time is spent data crunching. Whilst similar to the global average, retailers in North America and Germany cited better collaboration with suppliers as their second issue, making this a higher priority than the average. Some retailers in both countries also stated that they had worked on supply chain issues internally and felt that most benefit would be made from external supply chain improvements. In contrast, Nordic retailers listed handling promotions effectively as their second biggest issue, which was not seen as such a priority by retailers in other regions. This ties up with the fact that 84% of Nordics retailers see forecasting effectively for promotions and promotional lift as a challenge.

Challenges regarding forecasting

When we look in more detail at the main challenges of forecasting effectively across the supply chain, forecasting effectively for promotions & promotional lift; and forecasting heavily seasonal items, the UK shares the same top challenges as the global averages. North American retailers are most concerned about forecasting for new products (73% see this as an issue compared to 58% for all retailers). In addition, the US tends to be the country where most new products are developed and launched, causing greater problems for North American retailers than elsewhere due to the typically higher proportion of new products in an assortment. German retailers’ top challenge is coping with changes in the rate of sale (85%), which is less of an issue for all retailers worldwide at 59%. This is followed closely by forecasting effectively across the supply chain (83%) and represents the top challenge for all retailers.

Visibility of the supply chain

Retailers globally recognise that they have a way to go before their supply chains are fully visible, giving themselves an average of 6.2 out of 10 for supply chain visibility. Notably though, UK retailers rate the visibility of their supply chain the lowest of all regions at 5.4 out of 10. North American, German and Nordic retailers have roughly same issues with their supply chain visibility, with North American retailers rating their visibility level at 6.5, German retailers slightly higher at 6.6 and Nordic retailers pretty much the same as the all countries’ average level at 6.0.

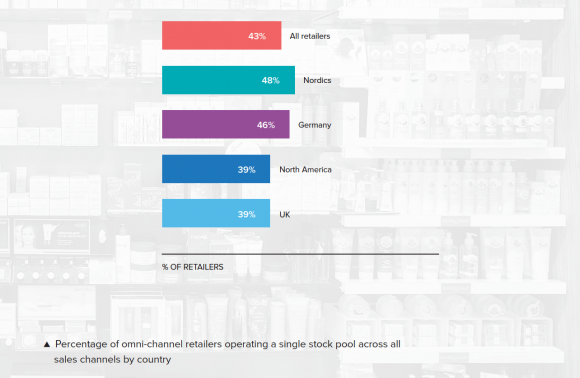

Operating a single stock pool across sales channels

43% of all omni-channel retailers, that have physical and online outlets, report that they operate a single stock pool across all sales channels, showing that the move to a single stock pool is gradually becoming more of the norm.

UK and North American retailers with more than one sales channel are marginally less likely to operate a single stock pool than the national average (both at 39% of retailers). German retailers with more than one sales channel are however marginally more likely to operate a single stock pool than average at 46% and Nordics based retailers even more at 48% against the international average.

Staff productivity

In terms of staff productivity, the global average full time equivalent employee (FTE) forecasts and replenishes an average of €172 million ($190m) of sales annually.

Retailers in North America are more efficient than retailers in other countries in terms of staff productivity with the average FTE forecasting and replenishing an average of €245 million of sales. This is probably because of the larger average size of the North American retailers interviewed who are able to realize greater economies of scale than in smaller countries. In comparison, retailers in Germany, the Nordics and the UK all perform similarly, with the average FTE forecasts and replenishes being an average of €98 million ($108m) of sales, €85 million ($94m) of sales and €73 million ($81m) of sales respectively.

Analysis and Reporting on Supply Chain

Unsurprisingly, given the above issues being experienced by retailers, research also reveals that only 42% of retailers’ current systems are able to accurately forecast of future out of stocks. Only 48% of systems have near real time replenishment and forecast calculation capability and just over 50% can only see changes in store demand and replenishment in their distribution centres the next day.

Furthermore, retailers are spending hours producing reports – 79 minutes for a standard report on product availability and inventory turnover for an item in all the warehouse and store locations in the business and 110 minutes for an ad hoc report.

Fran Riseley, Deputy Managing Director, Martec International comments: “This year’s report provides valuable insight into how countries compare in terms of the issues and challenges supply chain executives face and the visibility of their supply chains. Overall, it highlights that, for many, current systems, processes and technology are not supporting effectively supply chains. This is reflected by a high proportion (20%) of the retailers interviewed confirming that they have plans to replace or implement for the first time supply chain planning and execution systems.

Mikko Kärkkäinen adds: “The research makes clear that whilst there are some regional variations, overall retailers globally share the same supply chain challenges. Updating systems and processes will prove key to addressing these issues in coming years. Worryingly, 26% of retailers also claim that they do not invest in new systems due to the perceived complexity of them and 23% due to investment ties within existing ERP or in-house solutions that can offer no flexibility and can be complicated to improve.”

“Today’s advanced forecasting systems make it possible to manage several overlapping forecasts for different purposes. Additionally, Software as a Service (SaaS) business models offer the flexibility needed to streamline implementation and have the ability to adapt to changing requirements during, or even after, the implementation – without additional coding. As a result, organisations rarely need help managing or configuring the system. When looking to replace or implement new supply chain planning and execution systems, it will be those that rethink their supply chain planning processes and lead their people through change that will be most successful.”

To download a copy of the full ‘State of the Retail Supply Chain 2016’ research, please visithub.relexsolutions.com/state-of-retail-supply-chain-2016

*Statistics based on 126 retailers with combined sales of €551 billion ($608bn)