The majority of European consumers are currently subjected to opposing forces. On the one hand, this consists of uncertainty over Brexit, trade conflicts and weaker growth prospects in important export markets such as China. But on the other hand, consumers have a robust labor market, higher wage increases and moderate prices for crude oil.

Against this backdrop, GfK’s Geomarketing solution area evaluated various key European retail benchmarks and published the results in the free study “European retail in 2019”. The study analyzes trends and developments in 32 European countries and offers a 2019 turnover prognosis.

“GfK forecasts nominal turnover growth of two percent for brick-and-mortar retail in 2019 for the EU-27 countries,” explains the study’s lead, Dr. Johannes Schamel. “This growth is only slightly above the rate of inflation and comparable to the growth observed last year.”

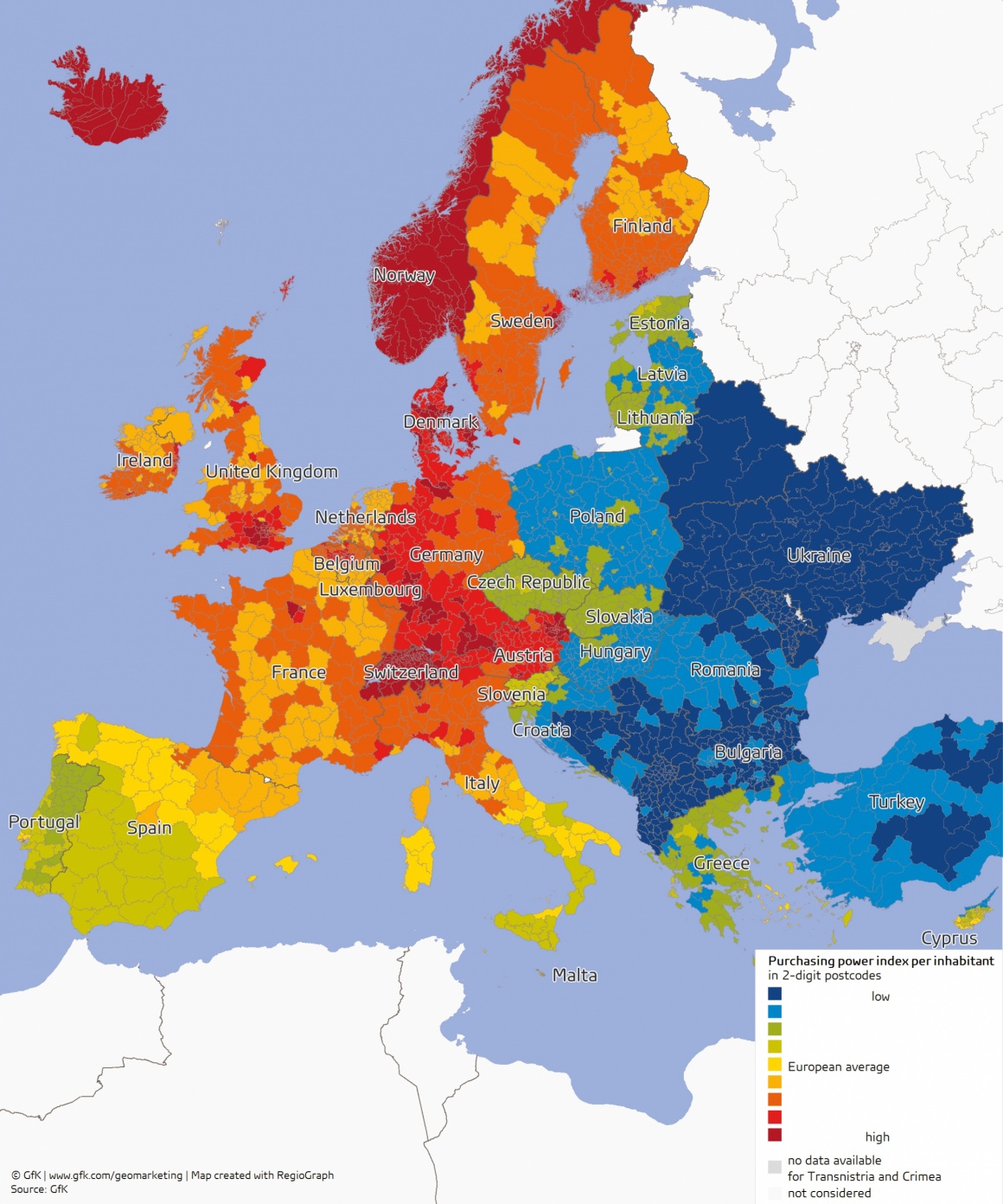

Purchasing power

In 2018, each citizen of the EU-27 countries had on average €16,878 of purchasing power. This equates to a nominal increase of 3.0 percent compared to the previous year. The ten EU nations with the highest per capita purchasing power gains this past year all have below-average purchasing power and were admitted into the EU as part of or after the eastward enlargement.

Turnover prognosis for 2019

In light of the continued dynamic growth in online retail, GfK anticipates nominal turnover growth of +2.0 percent for the EU-27 countries. The highest growth rates among the EU states are expected for Romania (+7.0 percent) and Lithuania (+5.9 percent).

Inflation

Sinking energy prices beginning already at the end of 2018 suggest that the EU’s rate of inflation will fall. Along with continuing trade disputes with the USA, the weakening European economy at the beginning of 2019 is dampening the mood of economists. As a result, a lower 2019 inflation rate of 1.6 percent is expected for the European Union.

Sales area provision

While the total sales area provision for all considered countries also increased in 2018, this happened at a significantly lower level compared to previous years. The EU-wide growth in sales area provision was counterbalanced by population growth. Given this, the per capita sales area provision remains at the previous year’s value of 1.13m². Among the top-three countries in terms of per capita sales area provision are the Benelux nations of Belgium (1.66m²) and the Netherlands (1.60m²) as well as Austria (1.62m²).

Sales area productivity

Europe-wide, there was no change to the top three nations compared to the previous year with respect to sales area productivity. The unchallenged forerunner continues to be Luxembourg (approximately 7,250€/m²), which even experienced a slight increase (+1.40 percent) in sales area productivity in 2018. Second and third place are occupied by Norway (approximately 6,430€/m²) and Switzerland (approximately 6,220€/m²) respectively. As is the case for sales area provision, there continues to be a large range in sales area productivity values among the considered European countries. These values are significantly lower among retailers the further east and southeast that one goes in the EU.

The study can be obtained as a free PDF.